The legendary investor started out as an ambitious, numbers-obsessed boy from Nebraska and ended up becoming one of the richest and most respected men in the world.

21 Things I Learned From Becoming Warren Buffett by Daniel Bourke/Medium.

I recently watched the HBO documentary Becoming Warren Buffett (official release date: 30 January 2017 ) To say that it was inspiring is an understatement. I would akin the documentary to being a complete biography of Buffett within 90 minutes.

An invaluable amount of knowledge is portrayed throughout the documentary and it doesn’t just include the best investing tips. Investing actually plays a small role throughout. HBO does an incredible job of extracting life lessons from Warren, his family and his peers rather than just focusing on what he’s best known for:

With a net worth of over $60,000,000,000, Warren Buffett is truly a one-of-a-kind billionaire. The legendary investor still lives in his modest home in Omaha.

At 86 years old, he drives to the office every morning to manage Berkshire Hathaway, the fifth largest public company in the world. But more surprising than his humble lifestyle is his moral core.

The same principles of decency and integrity that helped him pile up a fortune led him to give it all away in the largest philanthropic donation in history.

Becoming Warren Buffett chronicles the evolution of a boy from Nebraska who became one of the most respected men in the world, and the heroes who helped guide him along the way. By allowing access to his life and never-before-released home videos, Buffett offers a glimpse into his unique mind to help us understand what is truly important when money no longer has meaning.

I gained so much from the documentary I’ve written down my favourite takeaways. There is much to learn but this is a good start.

HBO Documentary Films presents Becoming Warren Buffett (1h 30min).

Watch FULL FILM below:

1. Treat Yourself Well

In the opening scene, Warren gives an analogy to a group of school students. He states,

“Imagine you’re going to be given a new car. Any car that you want is yours. It will be at the front of your house with a bow on it when you get home. There’s one catch. That’s the only car you’re ever going to have in your life. So you better take care of it.”

Warren then relates this analogy to the mind and the body.

“You’re only going to get one body and one mind in your life, so you better take care of it.”

Simple, yet profound. We can all treat ourselves a little better. This doesn’t mean in terms of extra materials and other various pleasures but in terms of physical and mental health. If you only had one car for the rest of your life, you’d take care of it. Do the same with your mind and body.

2. Compound Interest is an Amazing Thing

Einstein believed that compound interest is the eighth wonder of the world, it appears so does Warren.

“Over time, compounding does amazing things.”

Compounding isn’t just at play within the world of finance. It’s every where. For me, I try to get better at everything I do at least 1% per day. Of course, there is no way to quantify most things but aiming for small improvements every day is an incredibly powerful perspective. At the end of the year, 1% every day adds up to be a 3700% increase.

“To all the people who think becoming a billionaire is impossible, Warren buffet only had $1.4M at age 32. Compounding is nuts!”

Whatever it is that you’re doing or working on, remember how powerful compounding is. Most of Buffett’s wealth happened after he was 50. This was because of the foundations he laid in his 20’s, 30’s and 40’s and every day until now. It makes me think, what in my life can I improve by 1% every day?

3. Trust What You Believe

Birkshire Hathaway is a multinational holding company. What does that mean? They invest in other businesses and use the returns to fund other investments, in a perpetual cycle. They own 70 different businesses worldwide.

They don’t invest into anything Warren doesn’t believe in. Most of his investments are in company’s that he has spent years researching and reading about. Before he makes an investment decision, he has to believe in the investment. It’s obvious where this ideology has gotten him, as well as those involved with Berkshire.

What decisions have you made that you didn’t believe in? Where did these decisions end up taking you? Choosing what you believe in is hard but it’s always right for you.

4. Don’t Be Afraid To Reach Out

After graduating college, Warren didn’t get into Harvard.

Not getting into Harvard was one of the best things that ever happened to me.

After being denied admission to Harvard, he wrote a letter reaching out to one of his favourite authors. He thought the author was dead but he turned out to be a professor at Columbia.

In the letter, Buffett mentioned that he was interested in studying what the professor had to offer. The professor admitted Buffett to the college. It would be here where he met Benjamin Graham, the author of The Intelligent Investor, one of Warrens favourite books.

Several times throughout the documentary Buffett mentions how influential Graham was throughout his life and career. If he didn’t reach out after being denied entry to Harvard, Graham would have never entered Buffett’s life. Next time you fail at something, try again or reach out and try something else. You never know what’s waiting on the other side.

5. Investing

He learned the two rules of investing from the same Benjamin Graham mentioned above.

1.) Never lose money.

2.) Never forget rule number one.

These two rules can be applied to many aspects outside of investing. Set the system up so you always win. Whatever your goals may be, alter the first rule to suit you. The second rule always remains the same. For more on creating winning systems, I suggest reading How to Fail at Almost Everything and Still Win Big by Scott Adams.

6. Communication is Key

“I was terrified of public speaking. I would throw up before speaking in public.”

Warren realised that if was going to live the life he wanted, he needed to get better at communication and public speaking. He took a public speaking course by Dale Carnegie and values this as one of the best things he’s ever done.

“It worked. It’s the most important degree I have.”

He hangs the course certificate on his wall in his office, rather than his other various degrees.

Communicating with other people is an invaluable life skill. For any field you’re in, communication of some kind is required. Even outside the world of business and work, communicating with friends and family members still takes practice.

When’s the last time you were able to effectively communicate the point you wanted to get across? I struggle with it every day. It’s on my list of things I try to improve by 1% each day.

7. Balance

He is close with all of his children. Family was still a big part of his life despite his massive wealth. He wasn’t rich and famous growing up. He just went to work, worked hard and came home for dinner to spend time with his family.

It was evident when watching his children speak about their Dad that they respected him dearly. With a career like his it would’ve been easy to be absorbed by the work. But it’s clear that the work wasn’t everything to Warren.

Without the family to go back home to every day, he probably wouldn’t have had the success he does now.

8. Circle of Competence

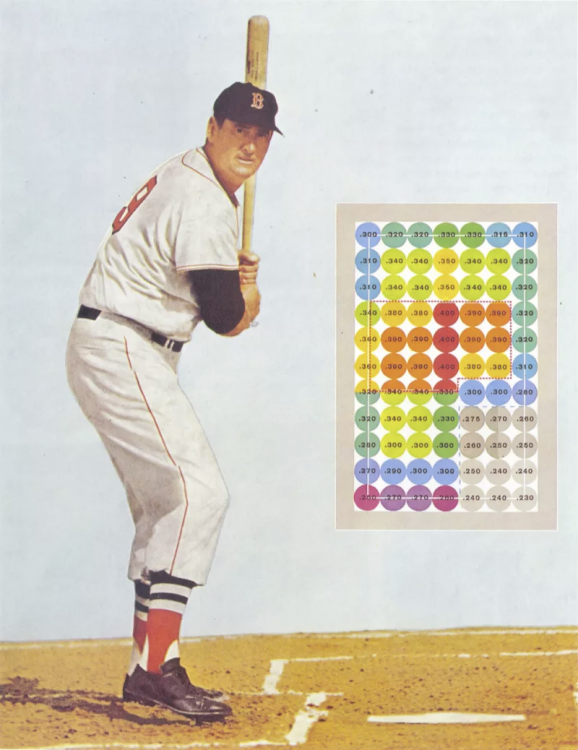

Warren often references the book, The Science of Hitting by Ted Williams. At first, I had no idea how this would relate to finance and investing but after he explained it, it was clear the principles can be related to anything in life. Buffett speaks of a particular figure that has a number of different coloured circles on it. The circles represent baseballs. Williams explains that he would be the most successful when he hit balls within the red square (seen below). Warren refers to this as the circle of competence. (Photo source: The hitting circle of competence )

“Know your circle well and swing when something enters it.”

Warren only invests in what he knows. His circle of competence. Any opportunity within the circle has a larger chance of success than anything outside the circle.

Sticking with what you know and what you’re good at is the first step to making the most of the opportunities that come your way.

9. Don’t Emotionally Tie Yourself To Things You Ultimately Can’t Control

“If you’re emotional about investing it’s not going to end well.”

Not every investment that Warren has made has been profitable. If he held onto all of these instead of moving onto the next one, I probably wouldn’t be writing this article. This statement holds true for many different aspects of life. Attaching emotion to goals, desires and materials is a great way to be disappointed.

So often we hear statements such as, “When I get this next job I’ll be happy.” Or “If I don’t get 100 likes on this Instagram post, I’m going to delete it.”

Living in this way is not sustainable.

Have goals, have desires but don’t be emotionally attached to them. Accept what you can’t control and take advantage of what you can.

10. The Right Companion

Warren and Charlie Munger have worked together for 49 years. Together, they’ve built one of the most valuable companies in the world and have helped millions of people along the way and stand to help many more.

Charlie and Warren know each inside out.

They thrive off each other. They regularly claim that they haven’t once had an argument in all their years of business. They disagree with each other but support each other no matter what.

Throughout the documentary, Warren regularly attributes the majority of his success to his wife Susie.

“Without her I wouldn’t be here today.”

“I picked the right one.”

Choosing the people you spend the majority of your time around is probably one of the most important decisions you can ever make.

Having the right partner in business and in life is paramount. It’s not easy to do but why should something so important be easy?

11. Ethics

Warren and Charlie believe that they’ve both done better in business because of having good ethics.

You can make money by double crossing people and ripping people off but that’s not sustainable, for any kind of relationship, especially business.

This principle comes back to treating people right. Treating other people right in any kind of scenario doesn’t always guarantee they will do the same in return. But it’s certainly more likely that if you’re treating people wrongly, it will eventually be your downfall.

It’s incredible how your view of the world can change when you start to believe that people are inherently good.

12. Keep the Circle Small

The Birkshire Hathaway office is 25 people. That’s it. One of the largest companies in the world in terms of market cap but only 25 people. Of course, it’s a holding company so their wealth comes from various sources but the immediate circle is very small.

This is a recurring theme throughout the documentary — surround yourself with the right people.

‘A lot of people think if you just had more process and more compliance — checks and double checks and so forth — you could create a better result in the world. Well, Berkshire has had practically no process. We had hardly any internal auditing until they forced it on us. We just try to operate in a seamless web of deserved trust and be careful whom we trust.’ — Charlie Munger

As the number of people you have to deal with grows, your ability to maintain healthy relationships with them all decreases. By keeping the circle small this allows you to work on the relationships that matter most.

13. Create the Exact Life You Want

Warren has created the exact life he wanted.

“I tap dance to work. It’s not work, it’s play.”

He dreamed up a good life and made it a reality. He was good at investing and loved it, so he followed that. It became a passion. Now every day he gets to live out his dream.

He wasn’t born an investor. No one is born with a passion. Buffett was lucky enough to realise from an early age what interested him and then said no to everything else.

What interested you as a child? When you were 6, 10, 12 years old was there something that you loved to do? Maybe that could be your passion. If not, try more things, passions are grown out of interests. Find more things that interest you and try them.

14. Never Stop Learning

Even after all of his successes he still reads 5–6 hours per day. This is another trait that he said has led to much of his success. Reading allows him to learn the lessons of others before he has to stumble upon. He also says that you can learn a great deal from books but without putting the knowledge into action, it’s useless.

“Learning about people is hard to do from inside a book, you need to be interacting with people.”

Where else can you get the entire life’s work of someone in the space of a few hours?

What many people see as a 300-page book is often the accumulation of thousands of hours and decades of work. The best way to learn something is to try it yourself but the next best way to learn is from someone who has already done it.

That’s the power of reading. Reading a book is the easy step though, putting into practice the knowledge you’ve learned is where the real growth happens.

15. Focus

Bill Gates and Warren Buffett are two of the richest men in the world.

One time Warren was at Bill’s house for dinner and Bills dad asked them to write down on a piece of paper what was one word to describe their success.

Focus.

They both wrote down the exact same word.

These two men have this trait in common. You can see it with Bill at Microsoft and Warren over the past 70 years of continually beating down on his craft of investing.

Warren finished college in three years because he wanted to get to doing what he loved. He figured out what his circle of competence was (see point 8) and didn’t swing at anything outside of it.

The power of focusing on one thing is immense. In a world of multi-tasking, single tasking is becoming rarer by the day. Focus on a single task at a time and you’ll be surprised by the results.

16. Taking Time to Think

Warren stated that he enjoys just sitting and thinking.

“Many people would see this as totally unproductive but many of my best business solutions and money problem answers have come from periods of just sitting and thinking.”

How often does this happen anymore? As Warren said, many people would find this unproductive, boring even. With the internet, we don’t ever have to be bored again.

As shown by Buffett, taking time to sit and think has potentially powerful outcomes. I wonder how many major world issues have come to someone whilst they were in the shower or just sitting and thinking about a problem?

After hearing the above quote from Warren it’s made me think about how I can incorporate more sitting and thinking time in my life.

17. The Long Game

Warren thinks that the long game is the best game. This comes back to his love of compound interest. This love of compounding was so strong that Susie wanted to give away their money years ago but Warren insisted on waiting so that eventually the give away would be far greater than what they had at the time.

Patience is another skill that is becoming rarer in the age of instant gratification. I’m guilty of a lack of patience every day but I’m working on it.

After learning about the power of compound interest and seeing how passionate Warren is about it, it’s made me start to value the long game much more than the short game.

Improving your skills by 1% every day results in a 3700% increase by the end of the year.

“Patience is bitter, but its fruit is sweet.” — Aristotle

18. Giving Back

His past wife, Susie, made it her life’s work to help people. Inspired by this, in 2006, Warren pledged to give away the majority of his wealth to the Bill and Melinda Gates Foundation. This pledge was the single largest donation ever given to philanthropy of all time.

It’s clear from Warren’s lifestyle that the money wasn’t everything to him. He doesn’t have the fanciest car or biggest house. He loves investing and helping others, the money is a secondary.

Helping someone else, whether it be through a donation of time or money is one of the most fulfilling acts you can do.

Some of the richest people in the world are also some of the unhappiest people in the world. Giving makes you richer than getting.

19. Reputation is a Fragile House

“It takes 20 years to build a reputation but only 5 minutes to destroy it.”

How often do you remember the one negative thing that someone did despite their decades of good deeds?

To handle the fragile house of reputation Warren uses and advises those he meets to use the front page of the newspaper rule.

“For every action, imagine whatever you choose to do is going to be on the front cover of tomorrows newspaper and your closest friends and family members are going to read the story.”

This is a simple yet effective rule. I’ve recently started to use this. It’s changed how I think about certain actions.

I think it’s also important to take it with a grain of salt. Sometimes the people closest to you won’t greatly appreciate what you do in the short term but if it’s best for you, it’s worth it.

Don’t let the views of others hold you back from doing something you enjoy.

20. Extreme Ownership

He took full responsibility as stand in chairman for the Salomon Brothers incident on Wall St.

Taking responsibility was something he didn’t have to do but he felt so strongly that things had to be put right, he took a stand. This ultimately ending up saving the company and the reputation of the American stock market.

Sometimes you have to stand up for what you believe in. When no one else would, Warren stood in. He took extreme ownership of the situation.

It’s easy to pass the blame to someone or something else, especially when it’s not your reputation at stake. It’s harder to stand up for what you believe in and take full ownership of your actions.

21. Life Is a Game Play it and have fun.

Warren loves the game of life. His love is infectious. It’s clear he does what he loves every day.

“Look for the job you would take if you didn’t need a job.”

This doesn’t just apply to a career. Life is work and work is life. You might as well have fun doing them both, whatever they involve. I had fun writing this article. Learning from Warren Buffett is far from a chore. I encourage everyone to watch the documentary and read up more on the life of Warren Buffett.

More

TIME – 5 Things We Learned About Warren Buffett From His New HBO Documentary

NewYorker – “Becoming Warren Buffett,” the Man, Not the Investor

NYTIMES – ‘Becoming Warren Buffett’ Goes Beyond a $74 Billion Fortune